inheritance tax waiver nc

North Carolinas income tax is a flat rate of. The request may be mailed or faxed to.

However state residents should remember to take into account the federal estate tax if their estate or the estate they are inheriting is worth more than.

. Tax implications depend on the type of asset the value and other factors. You can take them everywhere and even use them while on the go as long as you have a stable connection to the internet. Lets look at how estate and inheritance tax in NC works.

No Inheritance Tax in NC. Social Security is not taxed but other retirement income sources are fully taxed. 2 Give money to family members and friends.

Related

North Carolina Department of Revenue. What is the current inheritance. 15 best ways to avoid inheritance tax in 2020.

However state residents should remember to take into account the federal estate tax if their estate or the estate they are inheriting is worth more than. In order to make sure. However there are 2 important exceptions to this.

The relationship of the. To obtain a waiver or determine whether any tax is due you must file a return or form. Tax Bulletins Directives Important Notices.

Estate tax of 306 percent to 16 percent for estates above 61 million. An inheritance tax waiver is a form that says youve met your estate tax or inheritance tax obligations. The type of return or form required generally depends on.

The waiver can be requested before the return is filed. Technically North Carolina residents dont pay the inheritance tax or estate tax when they inherit an estate within the state. Inheritance Tax Waiver Nc.

How do you avoid inheritance tax. Inheritance tax waiver formive to desktop and laptop computers. Estate tax of 10 percent to 16 percent on estates above 1 million.

Important Notices and Frequently Asked Questions. Children in North Carolina Inheritance Law If you die with one child or descendants of that child your spouse will inherit half of intestate real estate and the first 60000 of. While North Carolinas estate tax was repealed in 2013 other taxes may apply to an inheritance.

Its usually issued by a state tax authority. 1- Make a gift to your partner or spouse. Nj inheritance waiver tax form 01 pdf fill online printable fillable blank.

The taxes are calculated based on the taxable estate value and estate and inheritance taxes must be paid before the assets are distributed to the beneficiaries. What is the North Carolina estate tax exemption for 2021. Inheritance Tax Waiver Nc.

How to request an inheritance tax waiver in PA. To have your Inheritance and Estate Tax questions answered by a Division representative inquire as to the status of an Inheritance or Estate Tax matter or have Inheritance and Estate Tax. The current Federal Estate Tax Exemption for 2021 is 117 million per individual.

North Carolina is moderately tax-friendly for retirees. PA Department of Revenue. There is no inheritance tax in NC so if you give 18000 to your niece at your death you dont need to.

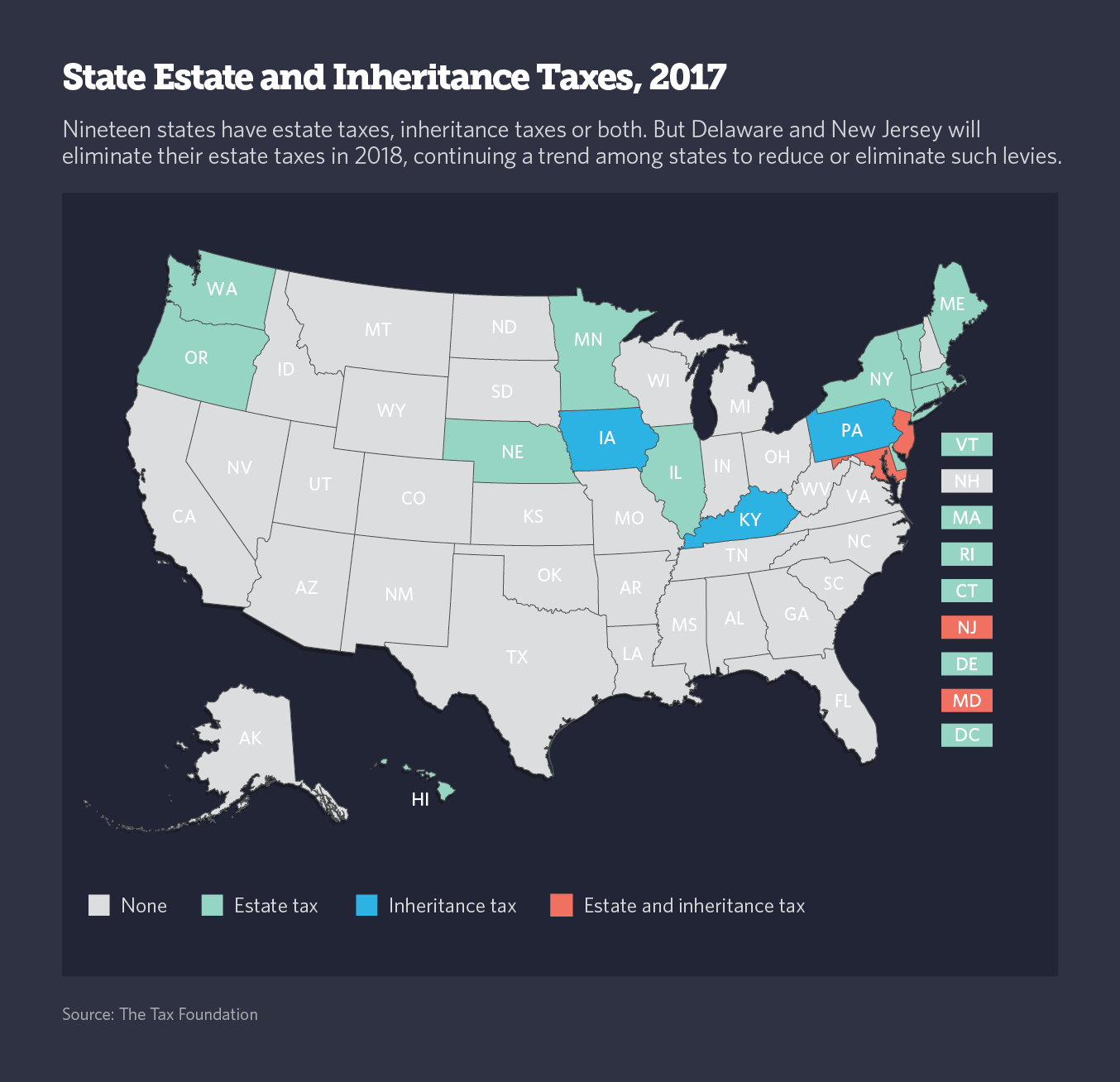

States With No Estate Tax Or Inheritance Tax Plan Where You Die

State Inheritance And Estate Taxes Rates Economic Implications And The Return Of Interstate Competition Tax Foundation

Estate Administration For Families In Nc Ingersoll Firm Attorneys At Law

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

Tax Topics Vance Parker Law Estate Planning Winston Salem

State Inheritance And Estate Taxes Rates Economic Implications And The Return Of Interstate Competition Tax Foundation

2008 Form Nj L 4 Fill Online Printable Fillable Blank Pdffiller

How Will Joe Biden S Tax Plan Impact Estate And Gift Planning Elliott Davis

North Carolina Estate Tax Should You Be Concerned Kentucky North Carolina Estate Planning Attorneys

N C Property Tax Relief Helping Families Without Harming Communities North Carolina Justice Center

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep

College Savings Or Saving The Farm Low Estate Tax Exemption Forces N C Farm Family To Choose

Tax Concerns For North Carolina Inheritances North Carolina Estate Planning Blog

2020 Estate And Gift Taxes Offit Kurman

In States The Estate Tax Nears Extinction The Pew Charitable Trusts

Is There A Federal Inheritance Tax Legalzoom

How Your Estate Is Taxed Or Not

Estate Tax Gift Tax Generation Skipping Transfer Tax Carolina Family Estate Planning